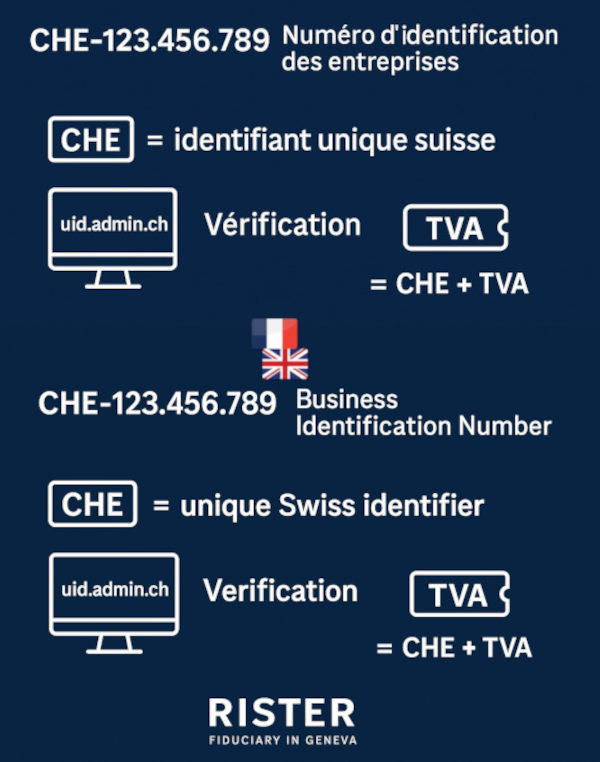

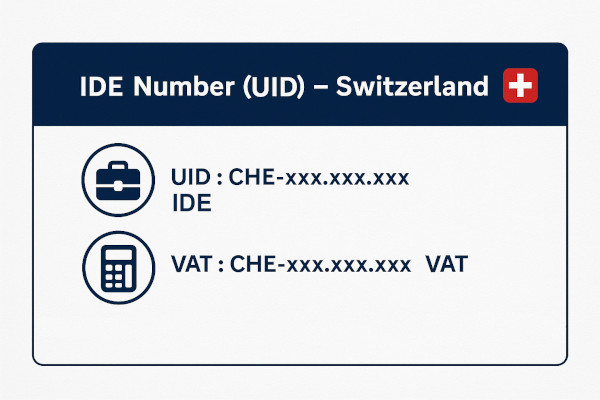

The Swiss Business Identification Number (IDE/UID) is the official identifier used by all companies operating in Switzerland. It appears in the format CHE-xxx.xxx.xxx and is used to identify a business with the Commercial Register, the VAT authorities and other public bodies.

For international entrepreneurs and cross-border businesses, the Swiss IDE number serves the same purpose as national business identification numbers used in other countries (such as EIN-type or company registration identifiers : it is the official company ID used in most administrative and commercial procedures.

In Switzerland, the Business Identification Number – IDE in French, UID in German – has become a cornerstone of administration and business operations. Behind the sequence CHE-123.456.789 lies far more than a simple code: it is the official identifier of your company for almost all authorities and many private partners.

This article of RISTER – Fiduciary in Geneva explains in practical terms what the IDE/UID is, what it is used for, who receives one, how to find it, and which official links you should use in your procedures (company incorporation in Switzerland, VAT, due diligence, etc.).

What is the IDE (UID) number in Switzerland? Simple definition

The IDE (Business Identification Number) is a unique identifier assigned to every active company in Switzerland: companies registered in the Commercial Register (SA/AG, Sàrl/GmbH, etc.), sole proprietors, foundations, associations and certain public entities.

Key characteristics:

- Format: CHE-xxx.xxx.xxx (9 digits)

- Country code: CHE = Switzerland

- Non-speaking number: the digits are assigned randomly; the number does not reveal the type of activity, canton or legal form.

- Authority issuing the IDE: the Federal Statistical Office (FSO) is the official body responsible for assigning and managing IDE numbers in Switzerland.

- Standardised identifier: it replaces previous numbering systems (Commercial Register number, old VAT number, etc.).

Since 1 January 2014, the Swiss business identification number (IDE/UID) has been the reference number for both the Commercial Register and VAT. A company no longer needs to manage several parallel numbering systems.

What is the IDE number used for in Switzerland? (VAT, Commercial Register, authorities, businesses)

The purpose of the IDE is to simplify both administrative processes and business interactions by providing a unique, stable, nationwide identifier. The Swiss IDE number is used as the standard company ID across multiple registers and systems.

In practice, the IDE is used to:

- Identify the company when dealing with authorities: Commercial Register, VAT, taxes, social security (AVS/AI), customs, etc.

- Facilitate B2B processes: contracts, invoices, general terms, supplier records and onboarding.

- Harmonise information across public registers: IDE register, FSO statistics, online portals such as EasyGov or cantonal e-government platforms.

- Avoid duplicated numbers and inconsistencies: the same company no longer appears under several different identifiers in the administration.

For entrepreneurs, fiduciaries in Switzerland or investors, the IDE is therefore a central tool for traceability, control and compliance.

Here is a summary table of the main uses of the IDE number:

| Use of the IDE number | Authority / Register | Practical example |

|---|---|---|

| VAT and taxation | Federal Tax Administration (FTA) | Checking a supplier’s VAT registration (CHE-… TVA) |

| Commercial Register | Zefix / cantonal Commercial Registers | Viewing Commercial Register status (active, deregistered), updating a company’s address |

| Social security | AVS / AI compensation funds | Registering a sole proprietor or updating social security data |

| Customs and foreign trade | Federal Office for Customs and Border Security (FOCBS) | Import/export declarations for Swiss companies |

| Economic statistics | Federal Statistical Office (FSO) | Identifying businesses for statistical surveys and data collection |

| Banking and AML/KYC | Swiss financial institutions | Bank account opening, verifying the company’s legal existence |

| Invoicing and commercial documents | Private companies | Including the IDE or IDE/VAT number on invoices, contracts and general terms and conditions |

Who receives an IDE number in Switzerland? Companies, sole proprietors, branches

All economically active entities in Switzerland that are known to an administration automatically receive an IDE number: companies, independent workers, foundations, associations and branches.

- Companies registered in the Commercial Register: SA/AG, Sàrl/GmbH, partnerships, etc. The IDE becomes the company’s official registration number in many systems.

- Sole proprietors (independent businesses): as soon as an independent worker is reported to a connected administration (Commercial Register, AVS, VAT, etc.), an IDE number is automatically assigned. The IDE register also lists sole proprietorships that are not themselves registered in the Commercial Register.

- Foundations, associations and public-law entities: when they are economically active and known to an administration (Commercial Register, VAT, AVS, etc.), they are also recorded in the IDE register.

- Branches of foreign companies: a branch operating in Switzerland receives its own IDE number linked to the Swiss branch.

Allocation is automatic as soon as an entity is reported to an administration connected to the IDE register (Commercial Register, AVS compensation fund, VAT authorities, etc.). The Federal Statistical Office (FSO) then sends an official confirmation letter to the company.

IDE and VAT in Switzerland: link between IDE number and VAT number (CHE… TVA)

For VAT-registered companies, the Swiss VAT number is directly based on the Swiss Business Identification Number (IDE/UID) and simply adds the “TVA” suffix. Example: CHE-123.456.789 TVA, which is the official format used for VAT identification in Switzerland.

For companies that are subject to VAT, the IDE forms the base of the Swiss VAT number. This creates a direct, uniform link between the IDE identifier and the CHE VAT number, and avoids managing two completely separate numbering systems.

Key points:

- Registration in the FSO IDE register is entirely free of charge for all companies.

- The company’s VAT status (VAT-registered, not registered, deregistered) is visible in the official public IDE register.

- For fiduciaries and tax advisers, the Swiss IDE register is therefore a quick way to check whether a company is actually VAT-registered in Switzerland, verify the validity of the VAT number (CHE… TVA) and see the date from which VAT registration applies.

Where can you consult and verify an IDE number in Switzerland? (Official UID register)

The official reference to check an IDE number is the online register of the Federal Statistical Office (FSO), available at www.uid.admin.ch. This is the central entry point for any IDE number search in Switzerland.

The online IDE register allows you to:

- Search for a company by business name, IDE (UID) number, address or other criteria.

- View all public data available: legal form, official address, Commercial Register status (active, deregistered), VAT status (registered or not), as well as any registered branches.

- Verify that you are dealing with the correct entity, which is crucial to avoid errors in contracts, invoicing or compliance processes (KYC, fraud prevention, fake suppliers, etc.).

⚠️ Important warning: the authorities regularly draw attention to directory scams. Certain private companies send forms imitating official IDE notifications in order to sell paid listings in non-official commercial registers. Only the FSO website is authoritative: IDE registration is completely free of charge.

When and how is the IDE number issued in Switzerland?

The IDE number is assigned automatically. No separate paid procedure or dedicated form is required. As soon as a company is reported to an administration connected to the IDE register, the number is created centrally by the FSO.

- Company incorporation (SA, Sàrl, etc.): registration with the Commercial Register, the AVS compensation fund or the VAT authorities automatically triggers IDE allocation.

- Start of activity as a sole proprietor: registration with the AVS compensation fund or with the VAT system also leads to automatic creation of the IDE record and assignment of the number.

Once the registration has been processed, the FSO sends an official letter confirming the IDE number assigned to the business.

How is the IDE number used in daily business? (Invoices, VAT, banks, Commercial Register)

For entrepreneurs, finance directors or fiduciaries in Switzerland, the IDE number is a central business identifier. It is involved in numerous administrative and commercial procedures and serves as a unique reference across several official registers. Below are the main practical use cases.

1. Company incorporation in Switzerland

The IDE appears quickly in the register after incorporation of a Swiss company such as an SA or Sàrl. From that point on, it becomes the official company identification number in many systems.

It can and should be used on the company letterhead, invoices, the website, general terms and conditions and in all correspondence sent to authorities.

2. VAT and invoicing

On invoices, the IDE forms the base of the Swiss VAT number, expressed as CHE-xxx.xxx.xxx TVA. This format is required for all VAT-registered companies.

During a tax audit or when checking incoming invoices, the IDE register makes it possible to confirm that a supplier is actually VAT-registered, thereby reducing the risk of errors and strengthening compliance.

3. IDE on invoices (important point)

The IDE number should clearly appear on each invoice when the company is VAT-registered. This number – for example CHE-123.456.789 TVA – allows the business to be identified and its validity to be checked through the official IDE register. Including the IDE/VAT number is essential to avoid disputes related to VAT and to secure supplier relationships.

4. Due diligence and KYC procedures

For bank account opening, Swiss financial institutions systematically require the IDE number as the company’s official identifier.

In AML/KYC checks, the IDE helps quickly verify the legal existence of an entity before deeper analysis (UBO, source of funds, transaction patterns, etc.). Professional assistance from a fiduciary in Geneva can also facilitate these compliance procedures.

5. Multi-register coordination

The IDE is used as a single reference key across several administrative systems: VAT, AVS, the Commercial Register, statistical and customs systems. This standardisation simplifies all updates of company information (address changes, mergers, change of legal form, liquidation, etc.).

FAQ – IDE / UID Number in Switzerland: most frequent questions

Is the IDE mandatory in Switzerland?

Yes. Any entity known to a federal or cantonal administration (Commercial Register, VAT, AVS, customs, etc.) automatically receives an IDE. It is an official and mandatory identifier used by all Swiss authorities.

Do I need to pay to obtain an IDE?

No. Registration in the official IDE register of the Federal Statistical Office (FSO) is free of charge. You do not have to pay to obtain a Swiss Business Identification Number.

What is the difference between IDE and UID?

There is no difference. IDE is the French term (Business Identification Number) and UID is the German term (Unternehmens-Identifikationsnummer). Both refer to exactly the same number.

What is the IDE (UID) number in Switzerland?

The IDE (Business Identification Number), called UID in German, is the official and unique identifier assigned to every active company in Switzerland. It appears in the format CHE-123.456.789 and is used to identify the company with authorities and administrative partners.

Who receives an IDE number?

All economically active entities in Switzerland, including:

- SA / AG

- Sàrl / GmbH

- Branches

- Sole proprietorships (independent workers)

- Associations and foundations

- Certain public-law entities

As soon as a company is reported to an authority (Commercial Register, VAT, AVS, customs), it automatically receives an IDE number.

How can I find or verify an IDE number?

You can check any IDE number for free through the official online register of the Federal Statistical Office (FSO) at www.uid.admin.ch. You can search by:

- Company name

- IDE (UID) number

- Address

- Status (active/deregistered, VAT status, Commercial Register status)

How do I know if a company is VAT-registered?

By entering the IDE number in the official IDE register. The company’s profile will indicate:

- “VAT-registered”

- “Not VAT-registered”

- The effective date of VAT registration, if applicable

This is the main tool to verify the legitimacy of suppliers and service providers from a VAT perspective.

How is the IDE assigned during company incorporation?

The IDE is assigned automatically. Once the company is registered with the Commercial Register or reported to an authority (AVS, VAT, customs), the FSO generates an IDE number and sends an official confirmation letter.

Can I request an IDE myself?

Generally no. Allocation is triggered by administrative registration (Commercial Register, AVS, VAT, customs). There is no separate voluntary application procedure for the Swiss IDE number.

Must the IDE appear on invoices?

Yes, if the company is VAT-registered. In this case, the number appears in the format:

CHE-123.456.789 TVA

If the company is not VAT-registered, including the IDE number on invoices is optional but recommended to identify the business.

Where should the IDE appear?

Recommended (and often expected) locations include:

- Company letterhead

- Invoices

- Contracts and general terms and conditions

- Company website

- Correspondence with authorities (tax, AVS, VAT, banks)

Do sole proprietors (independent workers) receive an IDE?

Yes. As soon as they register with the AVS system or obtain a VAT number, they automatically receive an IDE number.

Can a company have several IDE numbers?

No. A Swiss company has only one IDE number, permanent and unique. Only branches (Swiss or foreign) may have their own IDE numbers in addition to the parent company’s number.

What should I do if I receive a private invoice requesting payment for IDE registration?

You should ignore it. This is a common scam. IDE registration with the FSO is entirely free of charge. Only the official letter from the Federal Statistical Office is valid. Any invoice from a private directory provider is not related to the official IDE system.

Does the IDE change if a company moves to another canton?

No. The IDE is permanent and does not change when the company moves. Only administrative data such as the address, legal form or VAT status are updated in the register.

Is an IDE required to open a bank account in Switzerland?

Yes. Swiss banks systematically request the IDE as part of their KYC and AML procedures when opening business accounts.

Can the IDE be used abroad?

Yes, but only as a Swiss administrative identifier. It does not replace foreign tax identification numbers and cannot be used as a VAT number outside Switzerland.

What is the equivalent of the SIRET number in Switzerland?

The closest equivalent to the French SIRET number is the Swiss IDE number (UID). It is the official business identification number used to identify companies, sole proprietors, associations and branches active in Switzerland.

How do you obtain an IDE number in Switzerland?

You do not apply for an IDE directly. The number is created automatically when the business is registered with the Commercial Register or reported to an authority such as AVS, VAT or customs. No separate paid application is required.

Is the IDE really free?

Yes, the IDE number is completely free. Any demand for payment from private directory providers is unrelated to the official system and should be treated with caution as a potential scam.